Employee fraud hurts on so many levels. There’s the monetary hit, of course. But the discovery of employee fraud within an organization can sting emotionally and psychologically because it creates a breach of trust.

“Any organization with employees must, to some extent, entrust those employees with access to or control over its assets, whether that means keeping its books, managing its bank accounts, safeguarding its inventory, etc. It is this very trust that can make organizations vulnerable to occupational [or employee] fraud,” acknowledges the Association of Certified Fraud Examiners (ACFE) in its latest Report to the Nations.

This newest ACFE study on employee fraud shows a typical case causes a loss of $8,300 per month and lasts 12 months before detection. And it’s not only large employers who fall victim. Organizations with the fewest employees had the highest median loss ($150,000). In fact, it’s hard to find a business that hasn’t been the victim of employee fraud at some point. The HT Group Founder/CEO Mark Turpin has been there before. His advice? “Don’t get too comfortable,” he warns. “You’ve heard the saying ‘trust, but verify’? That’s good advice when hiring trustworthy workers but putting checks and balances in place, too.”

Some additional insights from ACFE:

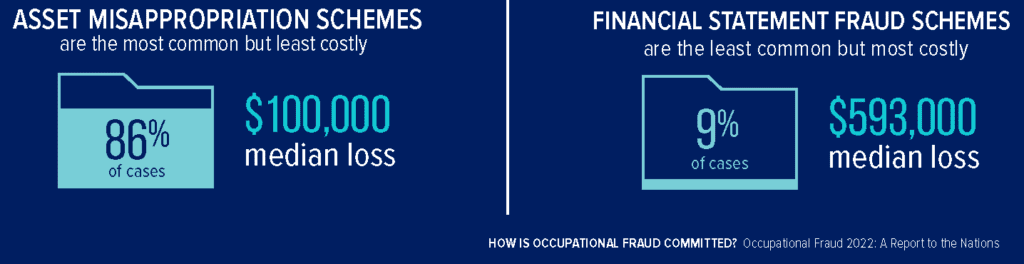

Asset misappropriation is the biggest threat. This type of employee fraud includes skimming and stealing cash, sales, or inventory. Financial statement fraud schemes, on the other hand, are the least common but the costliest. Here’s the breakdown:

Tips are tops. ACFE stresses the importance of making it easy and safe for workers to report employee fraud. About 42% of fraud is detected by tips, more than half of those coming from fellow employees. And while traditional telephone hotlines are still popular with large employers, email and web-based reporting are utilized far more often these days. Whatever the tip method, it’s critical to have one in place. Fraud losses were 2x higher at organizations without a hotline or reporting mechanism. Instead, organizations without tip lines are 3.5 times more likely to discover fraud through an external audit but also “by accident,” without looking for specific fraud.

Discrimination can trip you up. If you’re like many employees, you’ve made Diversity, Equity and Inclusion (DEI) initiatives front-and-center in past years. Fraud examiners are taking a close look at how things like implicit bias during employee fraud investigations can interfere with those DEI efforts. So while it’s important to step up fraud measures, it’s equally important to work with people who can help you conduct unbiased investigations so that “the actual wrongdoers are facing consequences and that everyone is entitled to the same level of safety in the fight against fraud,” ACFE states.

Background checks can help, but they’re not a silver bullet. Employment background checks are important and can catch potential fraudsters before they target your organization, but it’s important to note that only 6% of perpetrators had a prior fraud conviction. Many employees who commit fraud are doing it for the first time. For repeat offenders, you might be surprised to discover this: Only 58% of cases involving employee fraud are referred to law enforcement. About 39% of the perpetrators don’t even lose their job. Half of the organizations that didn’t refer cases to law enforcement cited internal discipline as the reason. Therefore, it can be tricky to uncover potentially risky employees, even if they’ve committed employee fraud in the past.

It’s clear that employee fraud can be a costly and difficult problem, especially when it comes to the complexity of human behavior. Turn to a reputable staffing firm like The HT Group to help recruit with this nuanced issue in mind. And for guidance on incorporating the appropriate checks and balances, feel free to turn to our advisors.